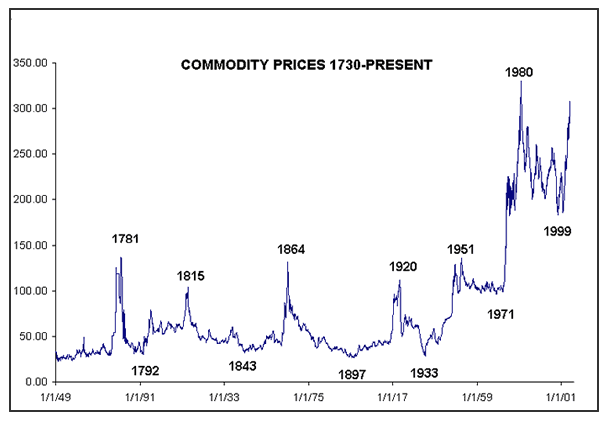

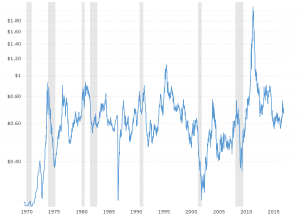

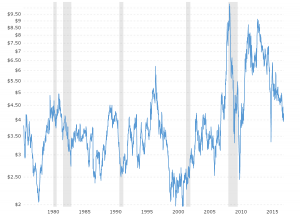

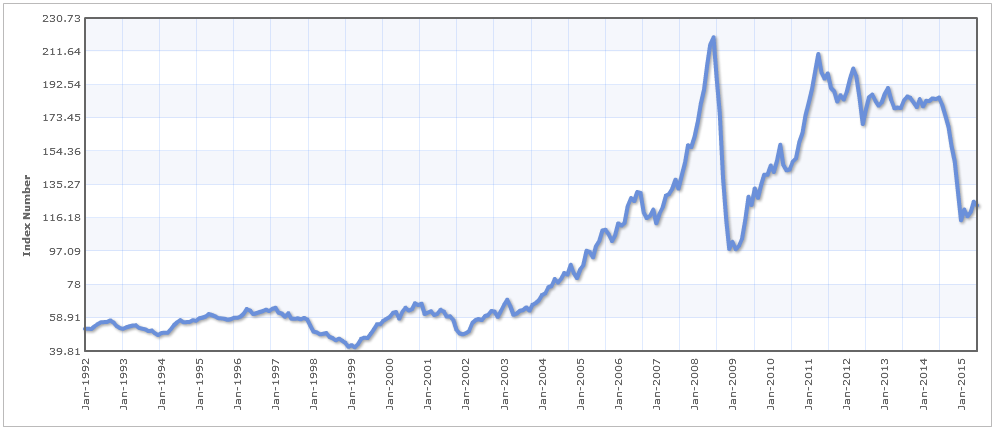

IndexMundi on Twitter: "Historical commodity prices updated with Mar'17 data. Commodity price index went down 3.83% with respect to Feb: https://t.co/249YAYnLUX https://t.co/qkDso0tlg2" / Twitter

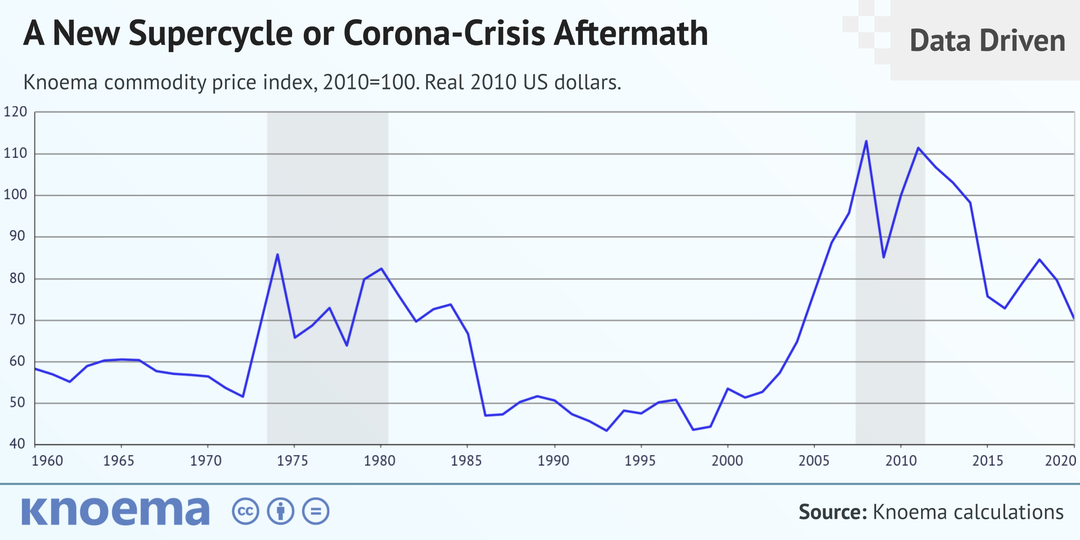

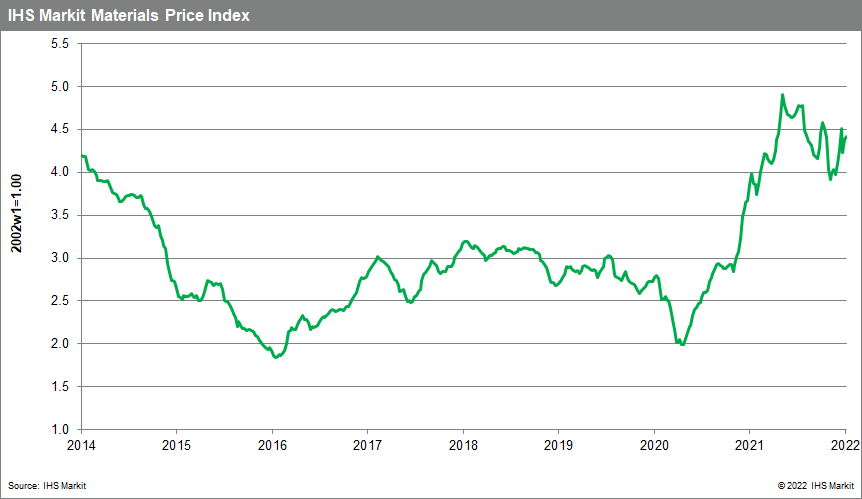

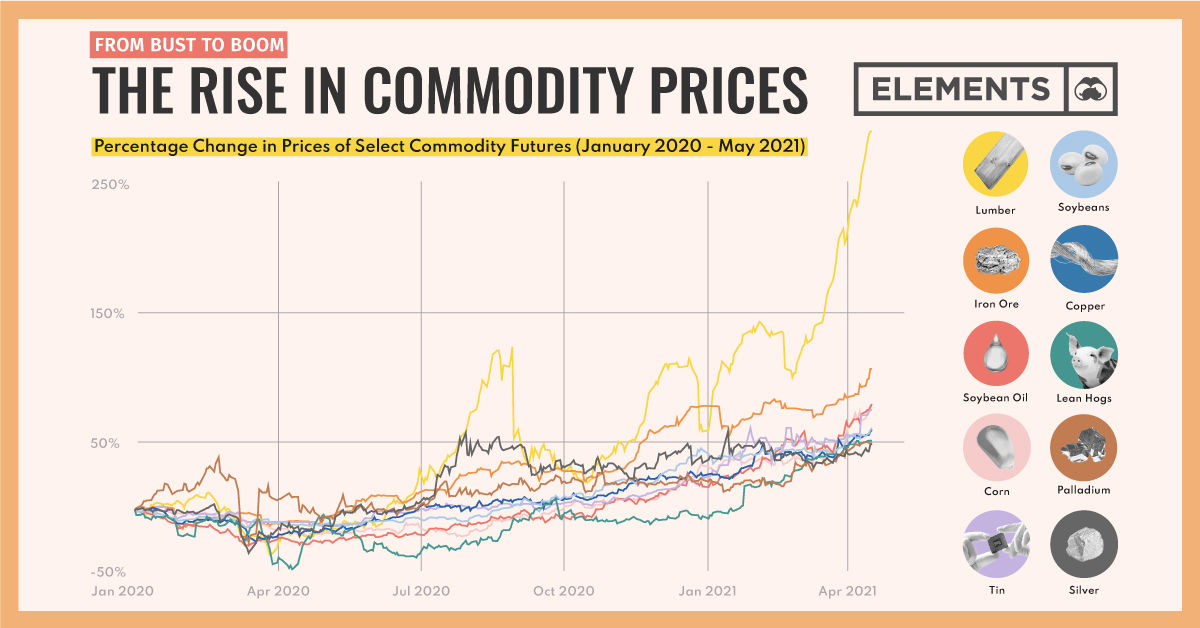

IndexMundi on Twitter: "Historical commodity prices updated with July 21 data. Sharp rise of commodity prices that started in May of 2020 continues. Explore prices in detail at https://t.co/i0RTCk0uEj https://t.co/WVIc0WrVFe" / Twitter