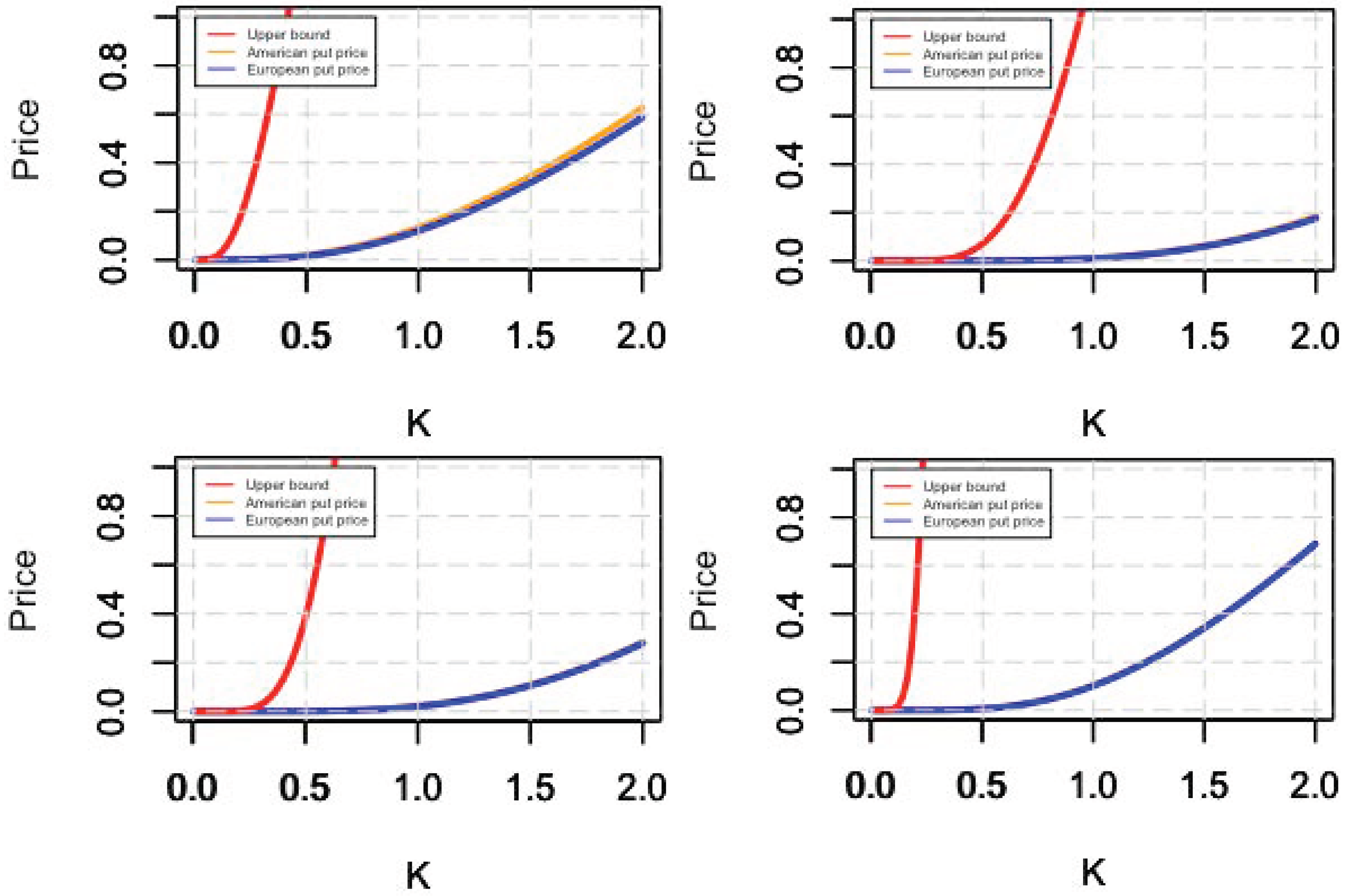

Put option price versus strike price, for different values of q. The... | Download Scientific Diagram

is relating bounds to relation between time to maturity and european put option price correct? - Quantitative Finance Stack Exchange

Lower bound for European put option prices -- potential contradiction with BS - Quantitative Finance Stack Exchange

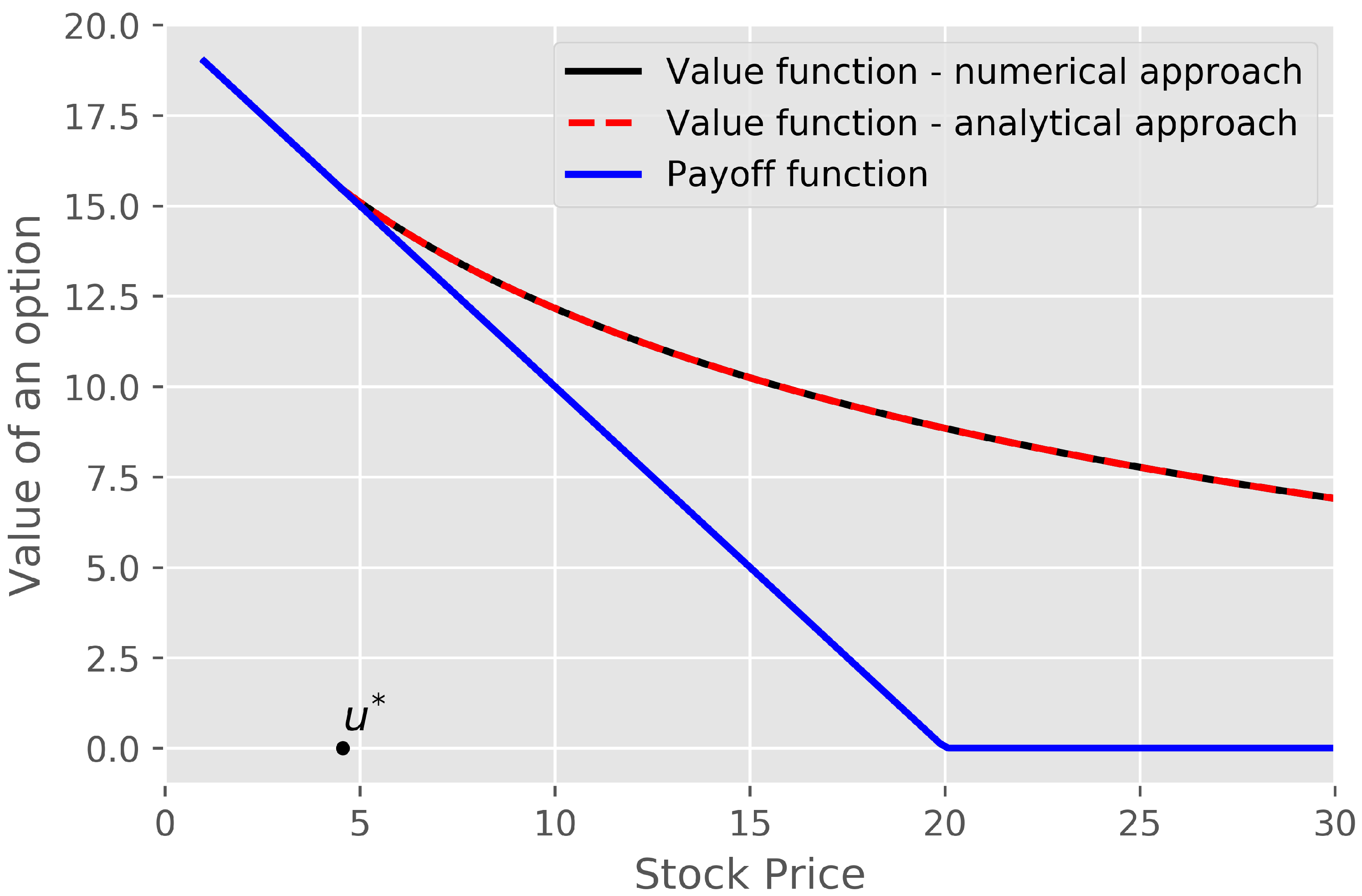

![PDF] American Put Option Pricing for Stochastic-Volatility, Jump-Diffusion Models | Semantic Scholar PDF] American Put Option Pricing for Stochastic-Volatility, Jump-Diffusion Models | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/1561acf9ebffb25cb93490077ae375c15b88b10d/5-Figure3-1.png)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)